Table of Content

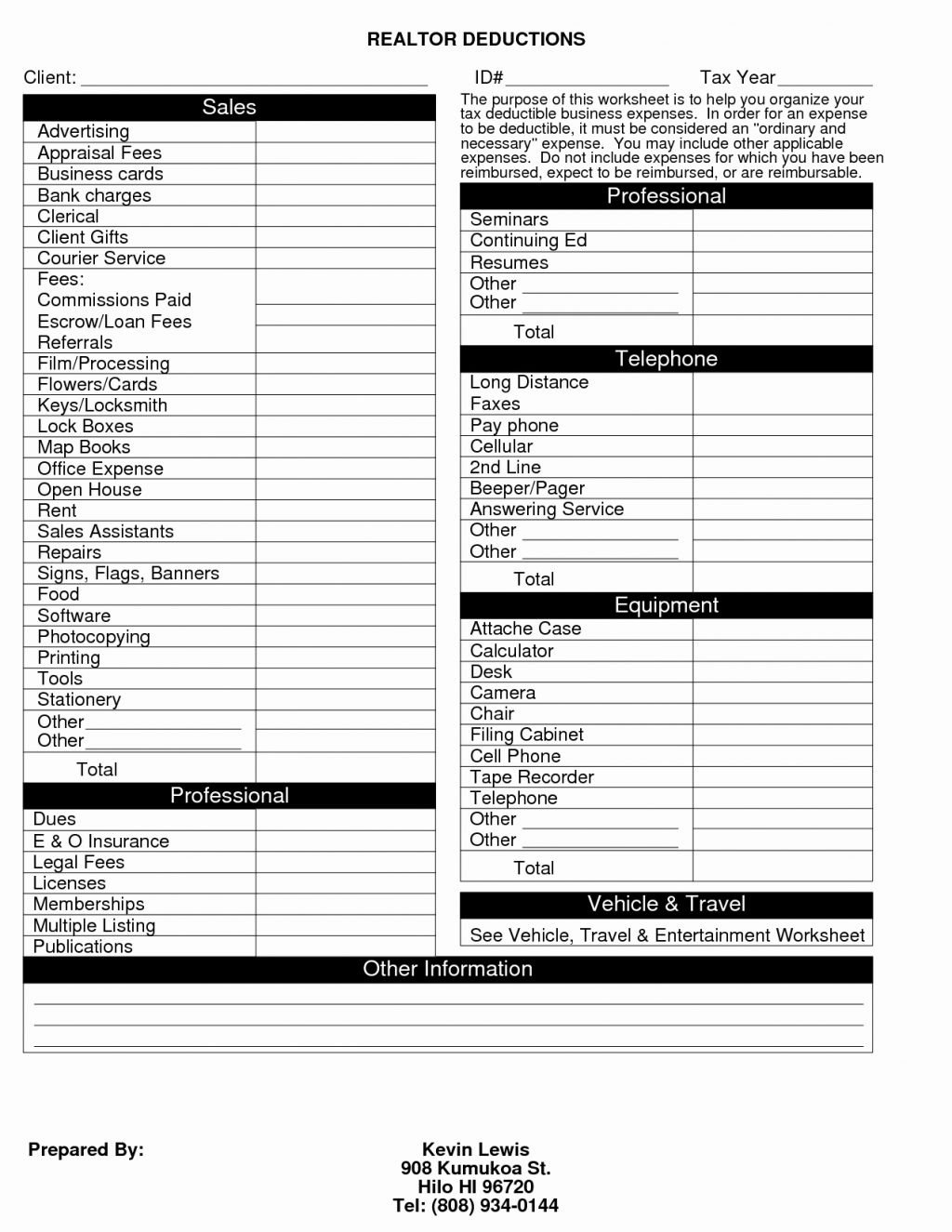

As such you may have to show the calculation you’ve used to claim your tax deduction or else you may be hit with a fine. You can use this short cut method to claim a deduction for tax returns submitted through myGov or a tax agent, until June 2021. You do not have to keep track of expenses or calculate the specific costs; you only have to keep records to substantiate the number of hours you worked from home. Timesheets, diary notes or rosters are examples of records for this purpose. As Abdul can claim mortgage interest expenses as a deduction, he will be required to pay tax on any capital gain he makes when he sells his home.

That you're reimbursed for, paid directly by your employer or the decline in value of items provided by your employer – for example, a laptop or a phone. Some of the information on this website applies to a specific financial year. Make sure you have the information for the right year before making decisions based on that information. We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. You must also apportion your expenses on a time basis if you only use that area of your home for work purposes for part of the year.

What Is the Home Office Tax Deduction (and How To Calculate It)

A prepayment that does not meet these two criteria and is $1,000 or more may have to be spread out over two or more years. It’s important to stay on top of your rental property tax deductions and claim them correctly to maximise your tax refund . Depending on the method you choose, you may need to work out your claim for some expenses separately. For example, work-related phone and internet costs are not included in the fixed rate method. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. With more people working from home than ever before, some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year.

If you work from home, you may be able to use the deduction, as long as you meet the qualifications. So if you’ve been diligently working away at home, whether as an employee or in your own business, speak to us about claiming all your rightful deductions. You are still required to keep a record of number of hours worked at home, but are relieved of the burden of calculating the precise deductible amount for each type of running expense. These can generally be viewed as those costs that directly result from using facilities in the home to help run the business, or to enable you to do a bit of work from home.

Banks Pledge Mortgage Relief For Customers During Lockdown

A business can usually deduct the costs paid to cancel a business lease. More and more property investors are seeking to improve capital values and increase rental income by renovating their properties, rather than purchasing anew. Buy and use separate computers, printers, and other electronic devices in your home office, so there’s no question that they are being used exclusively for your business. You can’t carry over losses from the prior year in which you used an actual-expenses deduction.

Itemised phone and internet accounts from where you can identify work-related calls and internet use, or other written records, such as diary entries if you don’t get an itemised bill. You can claim the portion of these costs related to the room or workshop you use as a place of business. Use our home office expenses calculators to work out your claim for work-related expenses you incur as a result of work you do from home as an employee. Doesn't include any part of the taxpayer's property used exclusively as a hotel, motel, inn or similar business.

COVID-19 Government Stimulus Package for Businesses

To do this calculation, multiply the square footage of your home office by $5. The major advantage of this deduction method is that you don’t need to itemize expenses and do complicated calculations. “Exclusive use” means you must use the specific space only for business purposes. The space can be part of a room and it doesn’t have to be physically marked off to qualify.

If you have a large office, are diligent about bookkeeping and pay a large amount in rent, you may want to use the regular method. The regular method also allows you to deduct depreciation and carryover losses. However, your home office doesn't need to be separated from another room.

Essentially, taxpayers can claim a deduction actually incurred through their income earning activities that is additional to their private expenditure . You can use our home office tax deduction calculator above to compare your tax deductions as it gives you the deductible amount using both the simplified method and the actual cost method. Then there are phone costs for business use, and even the decline in value of “plant and equipment” to the extent that those items were used for his income producing activities. He will however be unable to make any claims based on renting or owning the house, and also rates or insurance . Employees cannot claim deductions for occupancy-related expenses such as rent, mortgage interest, property insurance, rates and land tax. The exception is if you operate a business and use part of your home exclusively as a place of business.

In limited circumstances, you may also be entitled to claim occupancy expenses. If a business pays rent in advance, it can deduct only the amount that applies to the use of the rented property during the tax year. The business can deduct the rest of the payment over the period to which it applies. Business owners who rent their home and have a home office as their principal place of business may also qualify for a deduction. Sometimes a business must determine whether its payments are for rent or for the purchase of the property, because different tax rules may apply.

A deduction of up to $50 per year for work-related phone and internet expenses. You must keep basic records of work-related calls and text messages and, for data usage, time spent or data used for work purposes. Use this rate to work out what you can claim as running expenses on your tax return. It is a nominal rate set by the ATO to cover all home office expenses, rather than claiming them individually. You can still use the other methods of calculating tax deductions, but, you’ll have to keep receipts and other records for those.

Home ownership can bring tax benefits, regardless of whether you’re an owner-occupier or investor. This left many with fewer taxes to pay, but others with substantially larger taxes. Talk to your CPA to find out how the tax code changes affect you and your deductions.

Tim the teacher, for example, could be writing student reports next to the kitchen radio one day or on the front porch another day. There is no defined area from which the work is done, but Tim can still claim deductions for some utility usage such as gas or electricity (running expenses – see below). He just needs to apportion expenses and be able to show how he reached these amounts. A fixed rate of 52 cents per hour worked at home for additional running costs .

Generally speaking, you would meet the requirements if your company didn't provide an office for you or if you had some other business reason for you to work at home. If your employer pays for your rent, for example, you may not deduct that rent. The physical size of the business area is not always the most appropriate measure.

Jean Murray, MBA, Ph.D., is an experienced business writer and teacher who has been writing for The Balance on U.S. business law and taxes since 2008. Where you do more extensive work, such as a renovation or extension, the money you spend generally counts as capital works. In this case, you need to spread any deductions for the money you spend over a period of between 25 and 40 years. However, you’ll need to balance this saving against the fact that if you sell your home, the portion of it you use for your home office may attract capital gains tax .

This includes the depreciation in value of things such as curtains, carpets and light fittings in your home office, as well as in the equipment and furniture. We're a nation of freelancers and remote workers and it's common for business owners to work out of their homes or apartments. In 2019, 57 million freelanced in the U.S., which means many people will want to deduct their home office on their taxes. The cost of establishing and using a 'home office' has become a significant expense for many employees who now work from home on a regular basis.